Fintech Mobile App Development

Solutions

We are a trusted provider of comprehensive Digital Fintech Solutions.

FinTech improves the way in which established businesses and startups provide financial services to clients across the globe by means of mobile apps with the use of mobile devices and a touch of a button.

The FinTech industry is expanding at a high rate as we speak and will continue to do so for the foreseeable future. In the demanding century we live in, technology has become a resource that most individuals and businesses cannot operate without.

What is it?

FinTech means Financial Technology and refers to the combination and integration of the financial industry and technology. FinTech apps are designed to provide financial services through mobile applications such as mobile banking and financial apps.

What kind of app would you like to build?

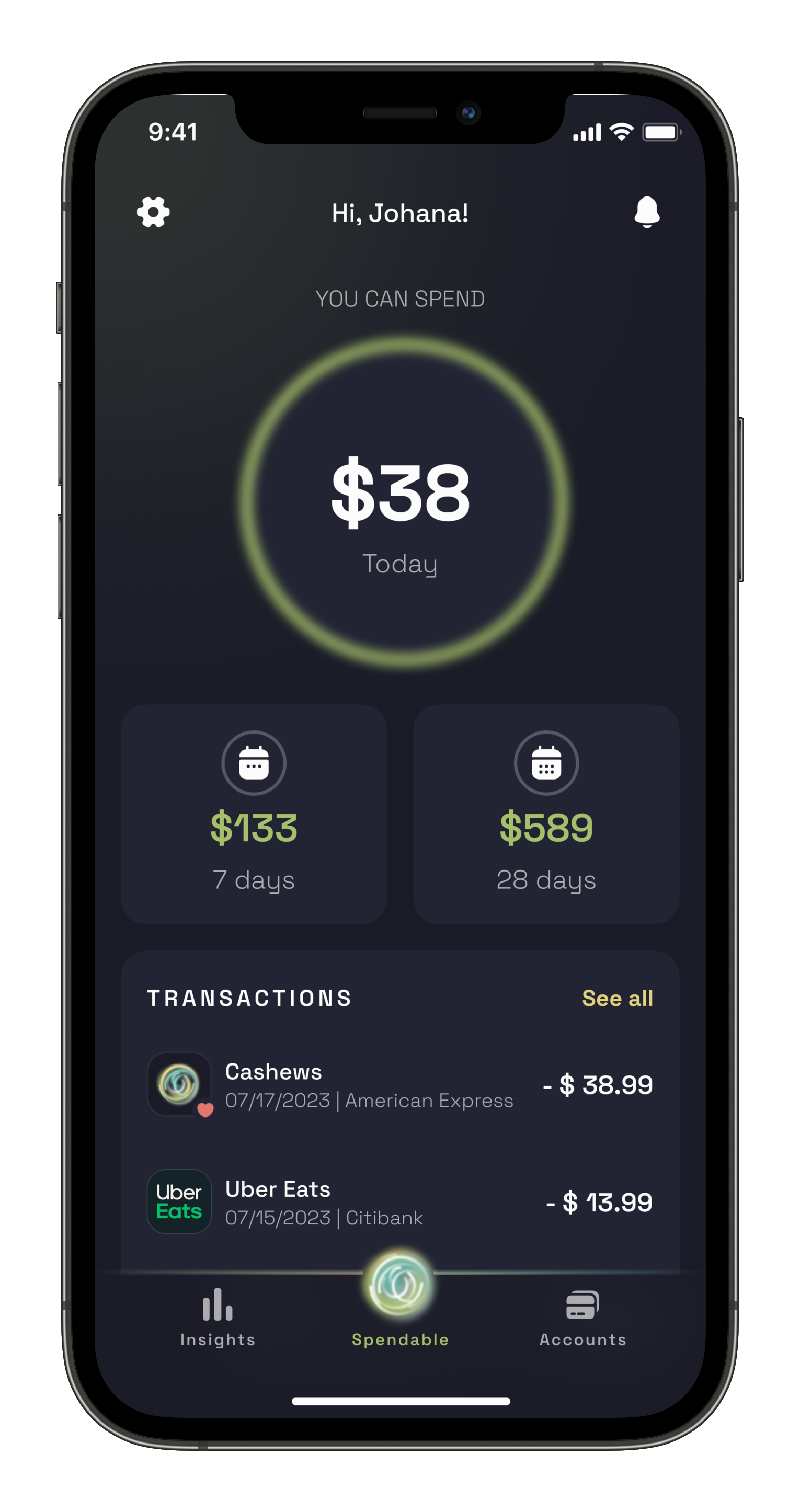

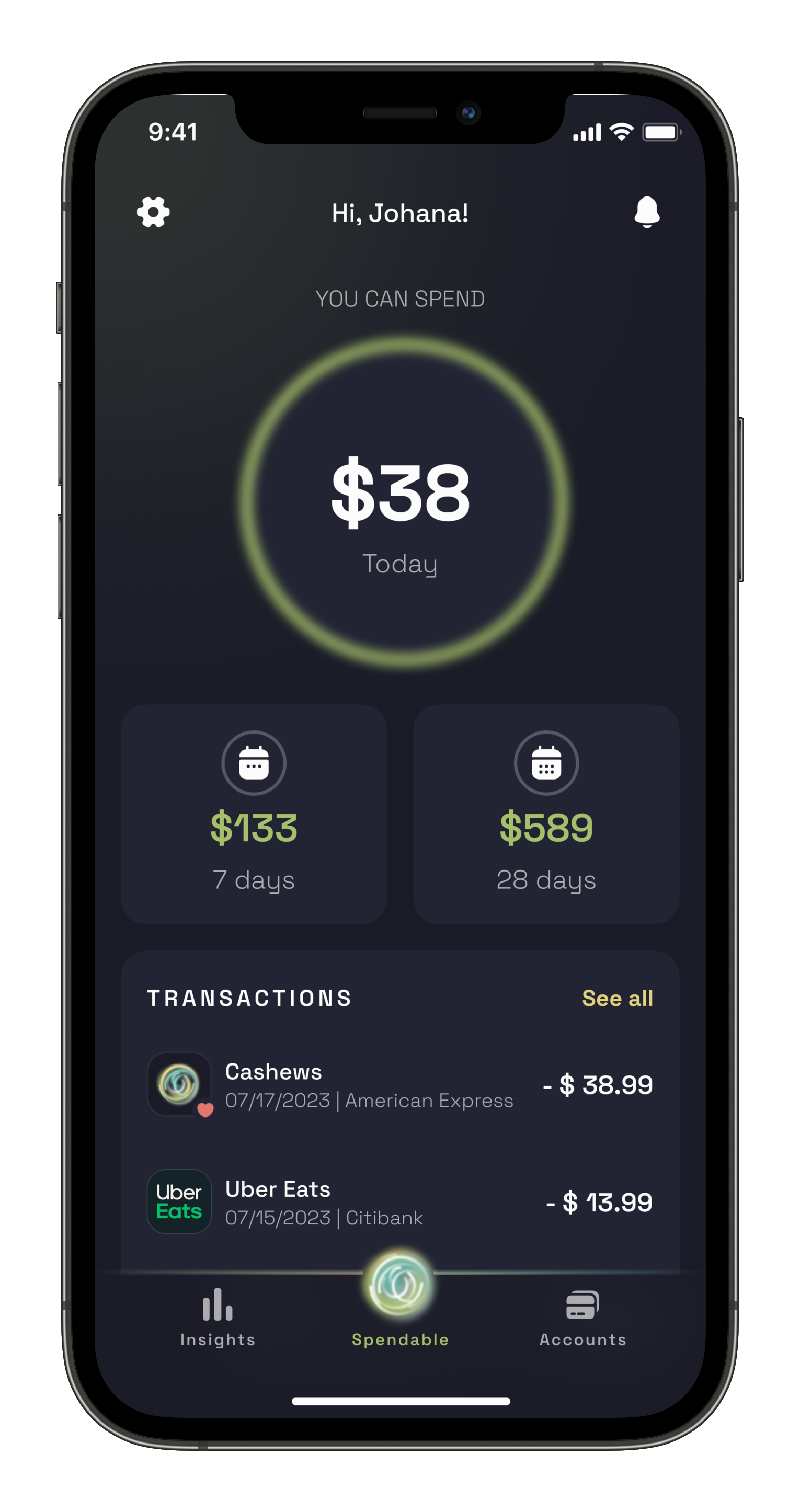

Budgeting and Wealth Management services simplifies and assists individuals to do their financial planning through these finance apps. These FinTech applications can promote better spending habits and instill the desire in clients to save money for future use.

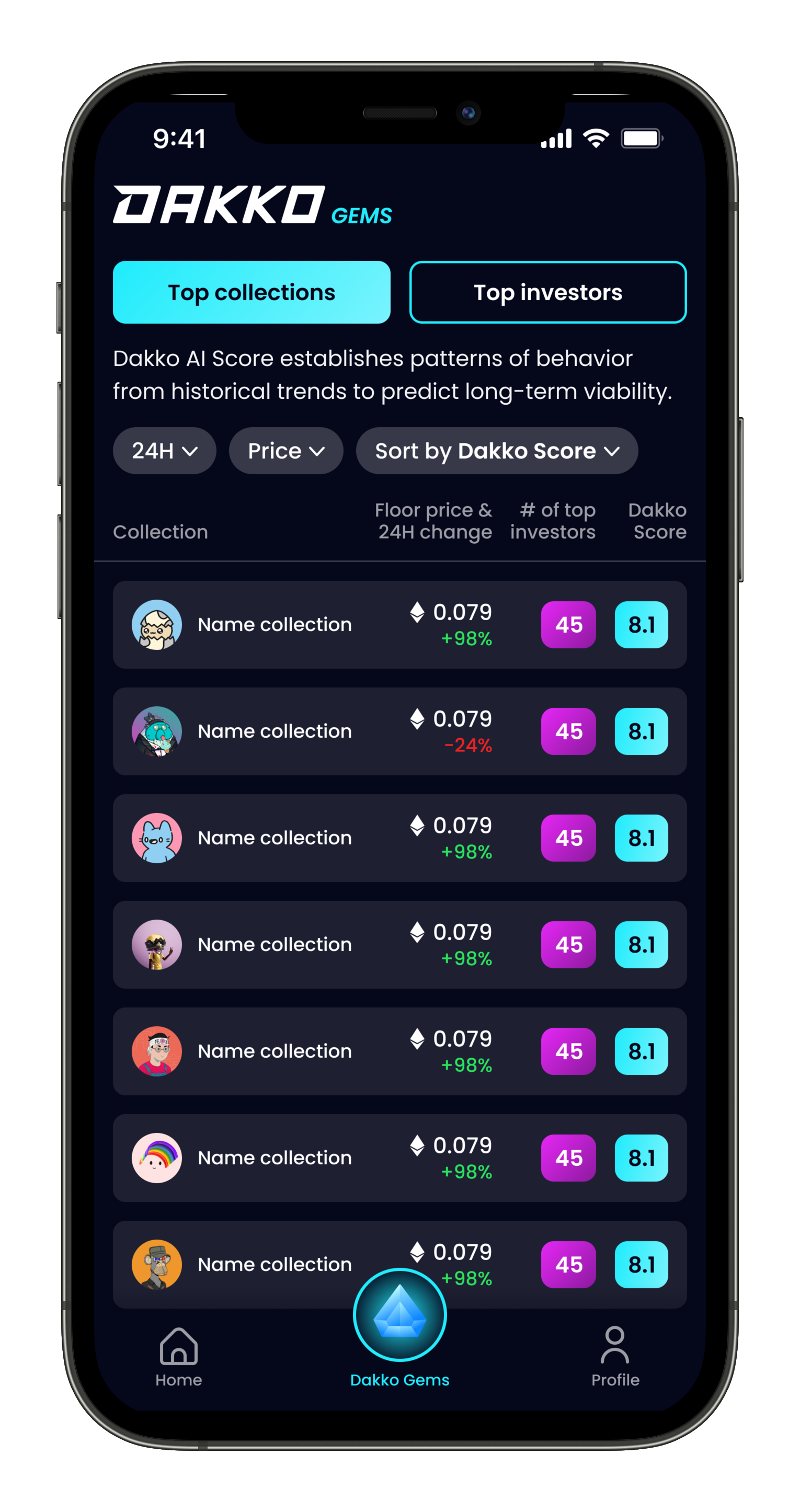

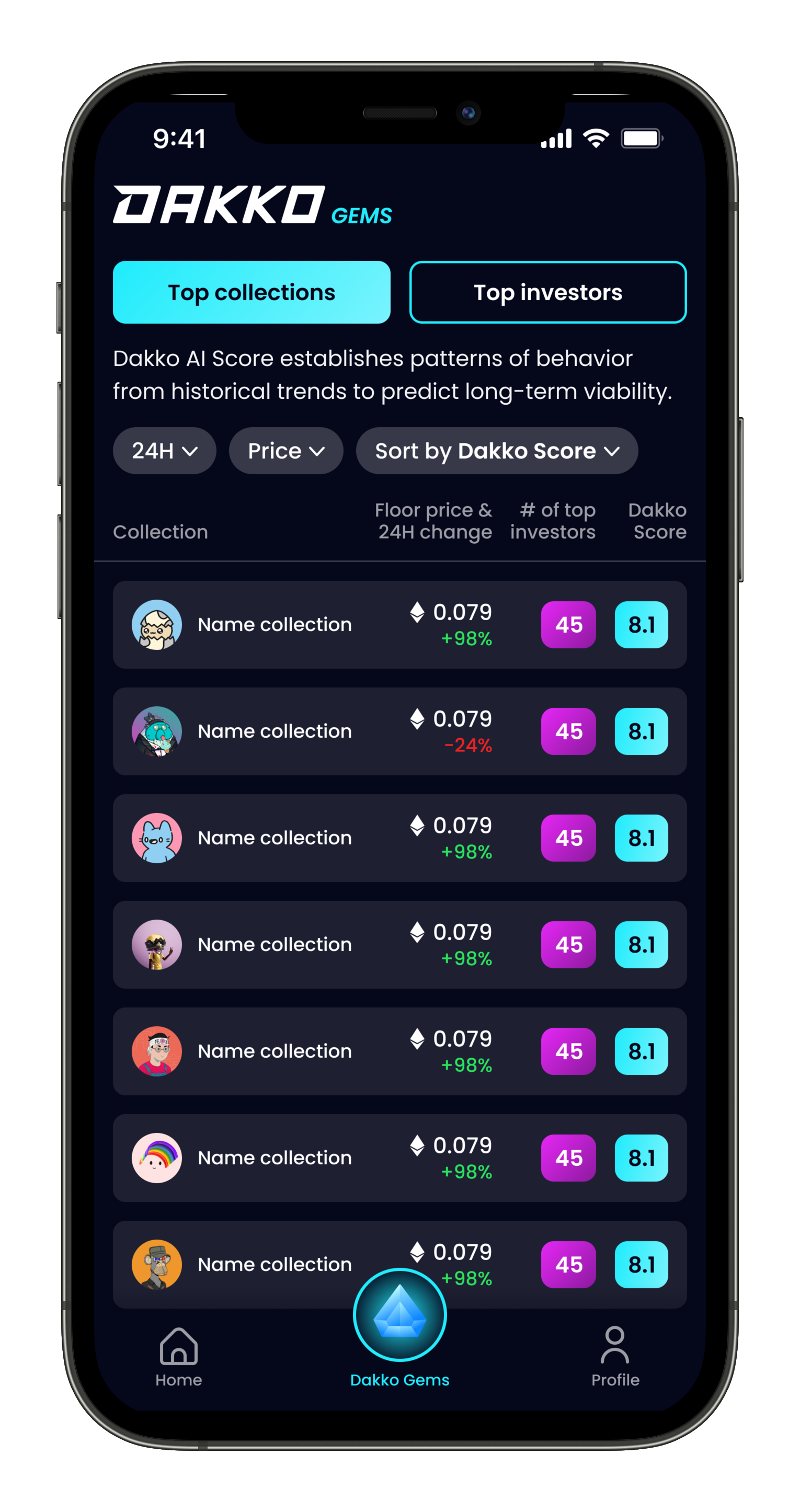

The digital and global currency apps significantly improve the way in which individuals trade and invest funds via mobile apps. Crypto apps motivate individuals to take risks within certain parameters for their desired outcome. These DeFI and Crypto apps can also be developed to automatically trade based on the market movements which simplifies modern digital currency trading.

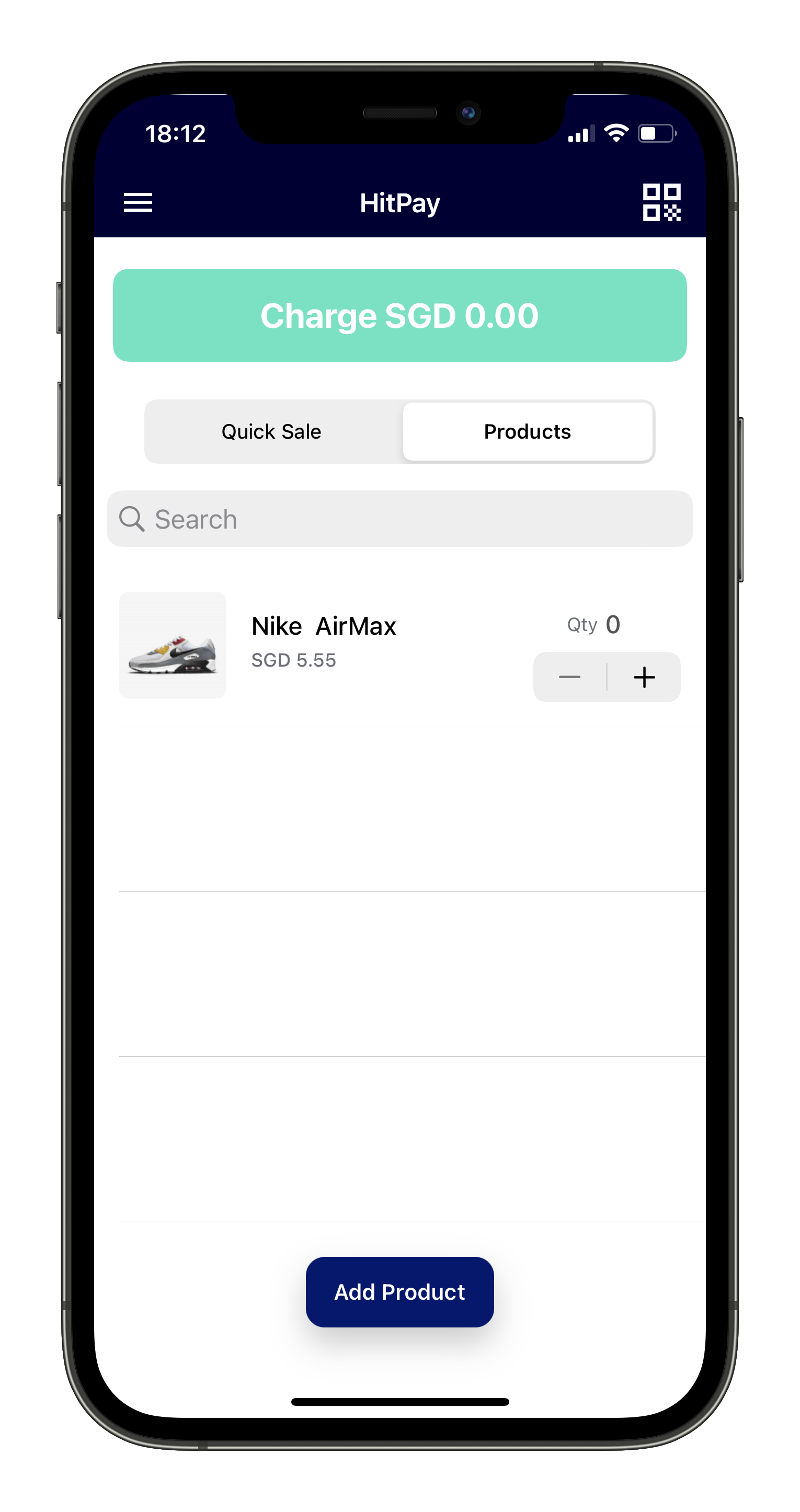

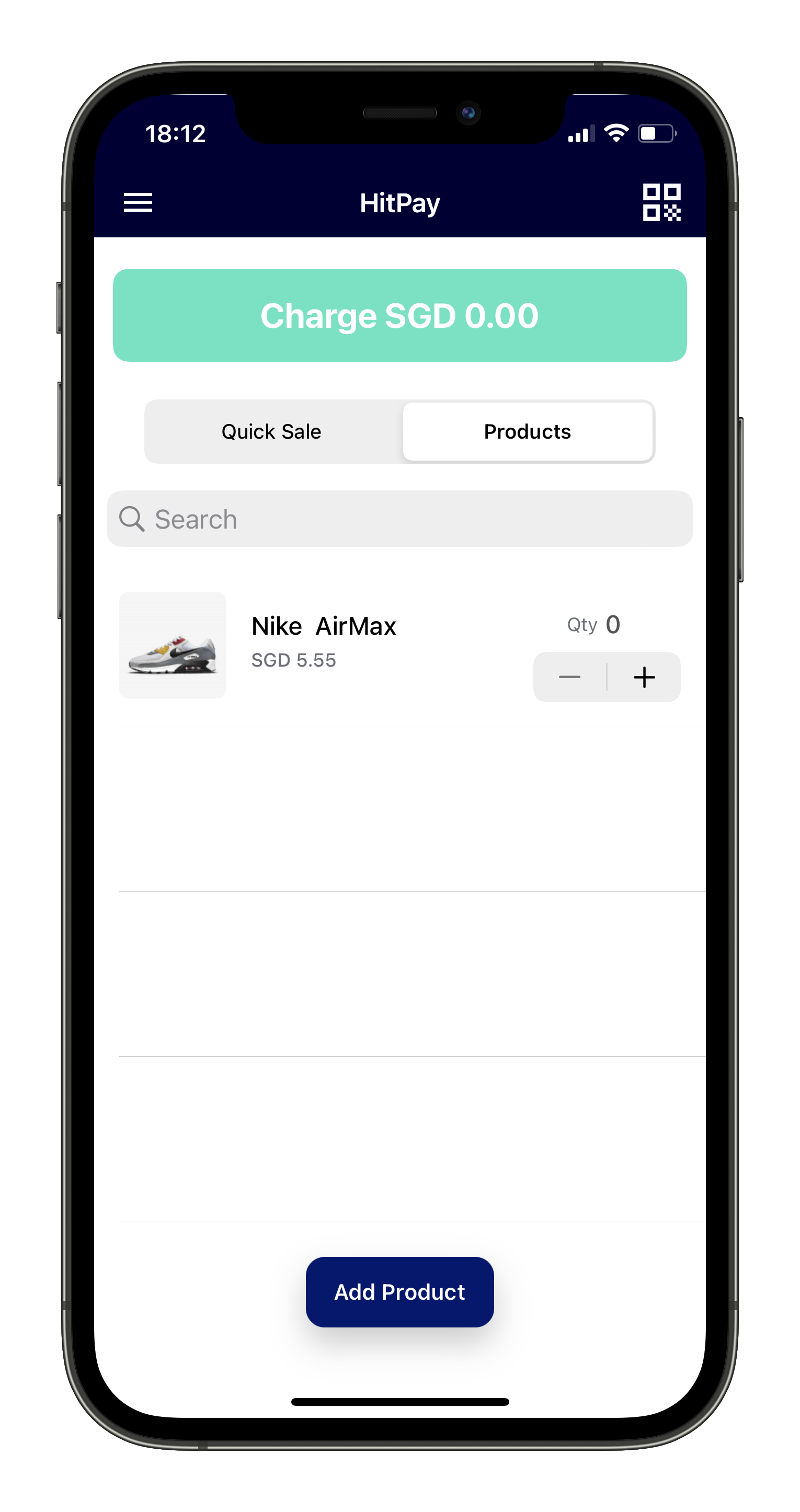

Point of Sale app solutions create a great foundation for businesses and individuals to sell goods and services and receive payments therefore with a touch of a button. Stock control and payment solutions are simplified through mobile POS apps. These apps also provide customers with a profile for tracking sales and viewing purchase history for easy record retrieval.

These digital banking apps boost the efficiency of modern-day banking services. Mobile and Neo banking apps are used to access funds, monitor balances, transfer money, lend money, make mobile payments, and view funds in your bank account through mobile devices and apps like digital wallets.

Clients use these apps to simplify their exchanges in the stock market. Stock trading apps promote fast access to the customer’s stocks and enable them to trade on-demand whenever the rates are at their best. Customers do not have to wait for exchanges to physically be concluded. They can proceed to do immediate changes as the demand rises and fluctuates.

Budgeting and Wealth Management services simplifies and assists individuals to do their financial planning through these finance apps. These FinTech applications can promote better spending habits and instill the desire in clients to save money for future use.

The digital and global currency apps significantly improve the way in which individuals trade and invest funds via mobile apps. Crypto apps motivate individuals to take risks within certain parameters for their desired outcome. These DeFI and Crypto apps can also be developed to automatically trade based on the market movements which simplifies modern digital currency trading.

Point of Sale app solutions create a great foundation for businesses and individuals to sell goods and services and receive payments therefore with a touch of a button. Stock control and payment solutions are simplified through mobile POS apps. These apps also provide customers with a profile for tracking sales and viewing purchase history for easy record retrieval.

These digital banking apps boost the efficiency of modern-day banking services. Mobile and Neo banking apps are used to access funds, monitor balances, transfer money, lend money, make mobile payments, and view funds in your bank account through mobile devices and apps like digital wallets.

Clients use these apps to simplify their exchanges in the stock market. Stock trading apps promote fast access to the customer’s stocks and enable them to trade on-demand whenever the rates are at their best. Customers do not have to wait for exchanges to physically be concluded. They can proceed to do immediate changes as the demand rises and fluctuates.

Why you should consider developing a fintech app

FinTech assists with the progression of the financial industry worldwide.

1.

Boost financial product and service sales

2.

Promotes adaptation to the agile financial industry

3.

Saves time through the FinTech remote capability

4.

Increased exposure to the financial market

Let’s discuss your project

Get free consultation and let us know your project idea to turn it into an amazing digital product

Talk to our expertsYour roadmap to creating a successful app

Our first step in the development process will be to establish the requirements and envisioned outcomes that you have for your fitness app. This is the most crucial step to ensure our vision aligns with yours.

Our app development team will provide you with details and expected due dates for certain phases in the mobile fitness app development process. This guideline should provide clarity and transparency on the course of your envisioned fitness and wellness app solution.

The third phase in our software development process will then be to design and create your desired fitness and nutrition app and with the help of our testing models we provide you with the opportunity to get a comprehensive overview on how the final product will perform.

Our first step in the development process will be to establish the requirements and envisioned outcomes that you have for your fitness app. This is the most crucial step to ensure our vision aligns with yours.

Our app development team will provide you with details and expected due dates for certain phases in the mobile fitness app development process. This guideline should provide clarity and transparency on the course of your envisioned fitness and wellness app solution.

The third phase in our software development process will then be to design and create your desired fitness and nutrition app and with the help of our testing models we provide you with the opportunity to get a comprehensive overview on how the final product will perform.

Why choose us

We strive to provide our clients with great satisfaction, and we do so for each project we take on. Our customer satisfaction rate is extremely high, and we pride ourselves on this accomplishment.

We strive to keep up with the newest modern trends and app requirements to ensure that we provide our clients with the performance required in this agile app development environment.

We offer an ideal combination of cost-effective rates with amazing quality to make sure the lowest pricing in our segment.

FAQ

Why is FinTech the future?

FinTech mobile apps are the foundation for most financial services. Business operations and finances run smoothly with the use of FinTech because it creates additional capacity within an organization due to the vast number of capabilities that FinTech apps provide.

How does a FinTech work?

FinTech combines Finance and Technology to create a mobile resource for customers around the world. These financial apps are used for a range of different financial services which includes mobile banking, crypto, and loan services completed through mobile financial apps.

Why is FinTech so popular?

The FinTech industry is growing more popular by the day, the main reason is because of the modern century we live in where most services are provided remotely and because of time, mobility, and cost saving benefits an increased amount of FinTech businesses and customers are making use of FinTech apps daily.

Why do banks need FinTech?

FinTech services play a massive role in the banking industry because there are capacity limitations to physical branches of banks. FinTech apps simplify the way in which customers can go about their daily banking and financial activities remotely without having to visit an actual branch. This promotes service delivery and assists to boost sales.

How do businesses use FinTech?

Businesses use FinTech mobile applications in numerous ways from using FinTech as the bridge between service delivery and payments to using the technology as a financial resource platform. FinTech startups can even use these apps for financial aid to get the business up and running by making use of loans through FinTech mobile applications.

How fast is FinTech growing?

FinTech is growing at a 25% compound annual growth rate and as the services improve the growth improves as well. FinTech is the way to go in this modern day and age.

Featured Articles

App Development

Considering Fintech App Development: Where to Begin?

Fintech is the modern-day term used to highlight the development of the fintech sector.

Read more

App Development

How Mobile App Development Can Benefit Your Business

Photo by Headway on Unsplash Mobile app development paves the way for technology to flourish in this modern century that we live in. These mobile applications are used for every activity that we complete in our everyday lives. Business operations are also provided through mobile apps, whether it be fitness services, food delivery services, or […]

Read more

App Development

How to Outsource Mobile App Development?

Outsourcing is a great option for businesses that do not have enough expertise to complete the desired project.

Read more

App Development

Native vs Cross-Platform Mobile App Development

Businesses not sure whether they should go with native development or choose a cross-platform framework.

Read more

Testimonials

Testimonials

Their overall quality is outstanding. Project management is great; their team is organized with communication, stays within deadlines, and I like how they keep us informed throughout the process. HotShots team is also consistent with their work, differentiating them from other providers.

Einar Jónsson

CTO

HotShots Labs were able to implement pixel perfect designs and build a great app around our concept. They are able to bring ideas into reality in a way that is well architected, maintainable, and built for future enhancement.

Jonathan Manuzak

Founder & CTO

Excellent, speedy work. Great skill and flexibility, as well as helpful input on our project.

Karim Bellazrak

CEO

Excellent team to work with. 5 stars across the board. We did a large project and they were always able to achieve great quality work.

Jack Bruten

Founder & CEO

Thanks a lot for your good cooperation during our project!

Coralie Guinot

Business Development consultant

HotShots Labs delivered all milestones ahead of schedule and within the projected budget. Their communication was always on point. I will be contacting them for future projects.

Ruairidh Galbraith

Digital Project Manager